Trojan Horse Strategy RE: the BBB

Analysis BBB - 2 provisions aimed at the judicial branch AKA the Trojan Horse Strategy

These two sections are directly weakening and targeting the judicial branch though language

Section 70302 — Limitation on Use of Funds to Enforce Certain Injunctions AKA Contempt

and

Section 12014 — Tax on Proceeds from Third-Party Litigation Financing AKA Anti-Jury

Disabling the Jury: Section 12014”

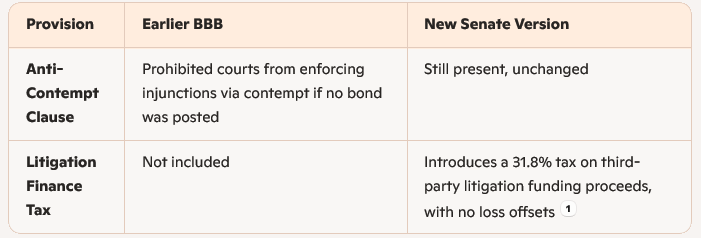

There is a fresh provision in the latest version of the One Big Beautiful Bill (BBB) that’s stirring up the litigation world, but it’s not the same as the anti-contempt enforcement clause we talk about later in this post.

My questions why this? What is it weakening?

💼 The New Provision: Targeting Litigation Finance Section 12014

Recently added to the Senate version of the BBB is a proposed 31.8% tax on litigation finance proceeds—a dramatic move aimed squarely at the third-party litigation funding industry. This is a multibillion-dollar sector where investors fund lawsuits in exchange for a cut of the winnings.

Key Features:

Tax Rate: Originally proposed at 40.8%, now reduced to 31.8% after pushback

No Offsetting Losses: Funders can’t deduct losses from gains, unlike most other investment sectors

No Exemptions for Nonprofits: Even tax-exempt organizations involved in litigation finance would be affected

🎯 Why It Matters

This provision is not about weakening judicial enforcement like the earlier anti-contempt clause—it’s about chilling corporate litigation by financially kneecapping the funders who often bankroll high-stakes lawsuits, including:

Class actions

Antitrust cases

Whistleblower suits

Environmental and civil rights litigation

Critics argue it’s a backdoor (the Trojan Horse) way to protect powerful corporations from being held accountable by making it harder for plaintiffs to afford litigation.

Undermine access to civil trials by taxing litigation funding (which disproportionately affects class actions and whistleblower suits)

Potentially discourage jury awards by making it harder for plaintiffs to reach trial in the first place

Contempt by Design: Section 70302 The Kingmaker

🧾 What the Provision Says

Buried deep in the BBB is a clause that states:

“No court of the United States may use appropriated funds to enforce a contempt citation for failure to comply with an injunction or temporary restraining order if no security was given when the injunction or order was issued.”

In plain English: if a judge issues an order (like halting a deportation or stopping a policy), and the plaintiff didn’t post a bond (which is almost never required in public interest cases), then the court can’t enforce that order through contempt proceedings.

🧨 Why It Was Added

This provision appears to be a direct response to the Trump administration’s repeated losses in federal court. Since returning to office, the administration has been blocked or restrained in over 80 cases. The courts have used injunctions and contempt threats to enforce compliance—especially in immigration, civil rights, and environmental cases.

By neutering the courts’ ability to enforce their own orders, the provision:

Shields executive officials from being held in contempt

Undermines judicial oversight of unconstitutional or unlawful government actions

Retroactively weakens existing injunctions, even those issued years ago

⚖️ What It’s Weakening

This isn’t just about jury trials—it’s about the judiciary’s enforcement power, particularly:

Contempt of court: A vital tool that allows judges to compel compliance with lawful orders

Checks and balances: The judiciary’s role in restraining executive overreach

Civil rights enforcement: Many landmark rulings (e.g., desegregation, police reform, immigration protections) rely on injunctions that could now be rendered toothless

Limit judicial enforcement through the anti-contempt clause (which weakens court authority)

As Erwin Chemerinsky, dean of Berkeley Law, put it: “Without the contempt power, judicial orders are meaningless and can be ignored.”

🧩 The Bigger Picture

Critics argue this is part of a broader strategy to sideline the courts and consolidate executive power. Some even call it a “king-making clause” because it allows the president to ignore court rulings with near impunity—unless plaintiffs can afford to post a bond.

That said, legal experts note that judges could still issue new orders with token bonds (even $1) to sidestep the restriction. But that’s a workaround, not a fix.

🧠 Strategic Implications

This is a new front in the war on legal accountability. While the anti-contempt provision undermines court enforcement, the new one undermines access to the courts themselves by targeting the financial scaffolding that supports complex litigation.

Differences

Budget Theater: Passing Policy by Pretending It’s About Money

The BBB is being passed through budget reconciliation, a legislative process that allows certain bills to bypass the Senate filibuster and pass with a simple majority. But there’s a catch: under the Byrd Rule, only provisions that directly affect federal spending or revenue can be included. Anything “merely incidental” to budgetary impact is supposed to be stripped out.

💸 Targeting the Money to Pass the Policy

Both the anti-contempt provision and the litigation finance tax are crafted to appear as budgetary measures, even though their true intent is policy-driven:

Section 70302 (anti-contempt): Instead of outright banning court enforcement of injunctions, it says “no funds may be used”—a budgetary restriction on court spending. That framing makes it reconciliation-friendly, even though the real goal is to weaken judicial power.

Section 12014 (litigation finance tax): By imposing a 31.8% tax on third-party litigation funding proceeds, it generates revenue—thus qualifying under reconciliation. But the deeper aim is to chill access to civil litigation, especially against powerful interests.

🧠 Why It Matters

This tactic allows lawmakers to sneak major structural changes into law under the guise of fiscal housekeeping. It’s like rewriting the rules of the courtroom by adjusting the thermostat budget.

Legal scholars have flagged this as a “Trojan horse” strategy—using budget language to smuggle in non-budgetary policy shifts that would otherwise be blocked.

“Section 70302 is like telling firefighters they can’t use water unless they brought their own hose.”

“Section 12014 slaps a toll booth at the courthouse door—and lets the wealthiest clients zoom through the EZPass lane.”

I say again We see you, we hear you and what you do affects us all.

Failing empires thrash around while they die, killing many innocents.